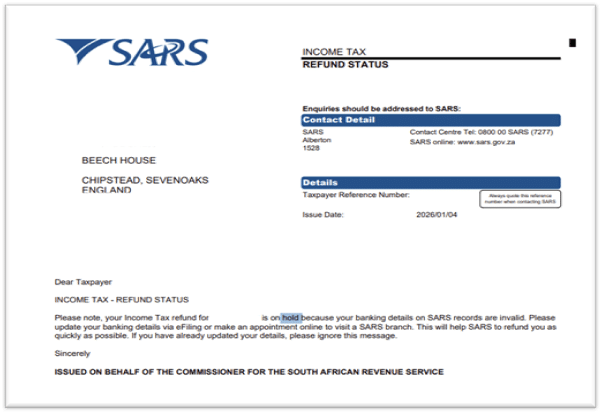

This trend coincides with SARS’s intensified verification and anti-fraud controls in recent years. While these measures strengthen the integrity of the tax system, they also mean that outdated banking and contact details now frequently trigger automatic refund blocks, particularly for expats.

The fact is that many South African taxpayers only discover that a tax refund is due once they receive standard correspondence from SARS stating:

What Blocks Payouts – Is This Even Legal?

In terms of section 190(2) of the Tax Administration Act 28 of 2011 (TAA), SARS is required to pay a refund only once it is satisfied that the amount is properly refundable and that all verification requirements have been met. Where banking details are outdated, closed, or not properly verified, SARS will automatically place the refund on hold until the issue is resolved.

In most cases, this is not a system error, but rather a compliance issue linked to outdated taxpayer information.

The Expat Reality: When Refunds Have “Nowhere to Go”

For many expats, the sequence is familiar:

- The taxpayer emigrates or relocates abroad

- South African bank accounts are closed

- Their residential and contact details change

- SARS profiles and eFiling details are not updated

When a tax return is submitted, often to finalise tax affairs or access retirement funds, SARS assesses a refund. However, the refund cannot be released because the banking details on record are no longer valid.

Getting Your SARS Refund Paid Overseas: The Hidden Stumbling Block

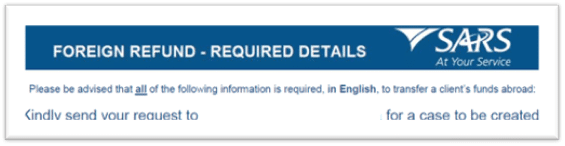

SARS allow refunds to be paid into foreign bank accounts. However, strict requirements have to be met.

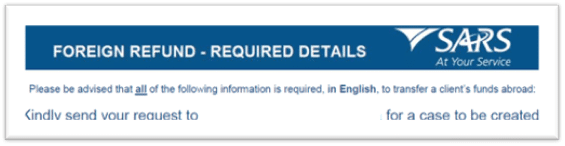

To release a refund to a foreign bank account, the taxpayer must:

- Complete and submit a SARS Foreign Refund Release form

- Provide confirmation of the foreign bank account in the taxpayer’s name

- Submit supporting documentation as required by SARS

- Ensure that their SARS profile and contact details are fully compliant

Until this process is completed and approved, SARS will keep the refund on hold.

Why This Process Often Causes Delays

Although foreign refunds are permitted, the process is not automated and typically involves additional verification.

Challenges often arise where the taxpayer no longer has access to their original eFiling profile, supporting documents are incomplete or incorrectly submitted, SARS requests further verification or clarification, or appointments are required to finalise profile changes.

It is also important to note that SARS will not pay refunds into call accounts, bond accounts, or credit card accounts, which further limits available options for taxpayers who have exited the South African banking system.

For taxpayers residing abroad, these requirements can significantly delay the release of refunds that are legitimately due.

Time Is Money: Let Experts Help You Keep Both

When South Africans move abroad, their to-do list is long: visas, housing, banking, and adapting to a new culture. Amid the commotion and disruption of relocating, updating your bank details at SARS is often overlooked.

A SARS refund being “on hold” does not mean it has been denied, it means SARS requires additional verification. For expats, this often involves confirming foreign banking details and updating outdated taxpayer information.

Managing a SARS refund hold, especially from abroad, requires an understanding of SARS’ administrative processes.

Experienced tax practitioners can assist by identifying the exact reason a refund has been placed on hold, preparing and submitting the necessary SARS Release of Funds documentation, verifying foreign bank account details in accordance with SARS requirements, and managing ongoing correspondence and follow-ups with SARS.

In matters like these, there is no substitute for expert guidance to ensure that tax refunds are released efficiently and in full compliance with applicable regulations.