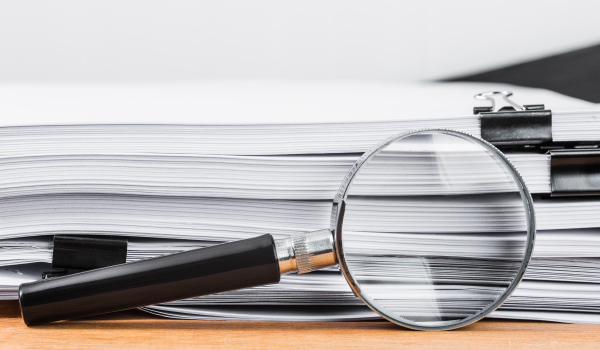

CROSS BORDER TAXATION

SIMPLIFIED TAX SOLUTIONS

The taxation of cross-border transactions and multinational entities is one of the most complex aspects of tax law. Internationally mobile employees and multinational entities face distinct reporting and compliance challenges. The challenge is compounded by the concerted enforcement efforts by revenue authorities across the globe.

With the expansion of operations into international markets comes the demand for more rigorous management of one’s tax affairs. Tax Consulting offers a multi-faceted service line in dealing with international tax matters.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)