What was once a simple “tick box” approach on tax returns for expatriates to change their tax residency status, has become a more technically nuanced and document specific procedure that demands accuracy, timing and strategic oversight. It goes without saying that South African expats can no longer resort to a self-assessment of their South African tax residency status without carefully considering the supporting documents they rely upon to break tax residency.

Procedural Overhaul of Tax Non-Residency on SARS eFiling

The proliferation of changes on SARS eFiling has reshaped the tax landscape of how taxpayers formally declare the cessation of their South African tax residency. There is a misconception that either (1) the process is automatic when you move abroad; or (2) the process is informal and does not require verification (i.e., SARS requiring documentary proof of the application submitted). Today, the formal SARS submission process must be supported by and requires minimum documentary evidence –

- RAV01 Declaration (i.e., Declaration to Cease Tax Residency);

- Copy of passport entry and exit stamps;

- A detailed letter of motivation and supporting financial disclosures; and

- A tax residency certificate or letter from the foreign jurisdiction.

Non-Generic AI, and Manual Verifications

These changes reflect SARS’s strategic commitment to compliance and transparency for regulating those who have or have not yet formalised their non-resident status. The eFiling system now includes the issuance of non-generic and non-automated responses to non-residency applications, which involve manual, non-AI generic responses, and stricter validation protocols—all designed to ensure that claims are substantiated and verifiably correct.

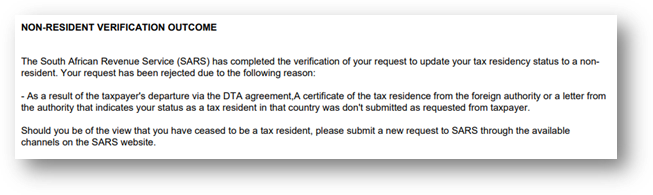

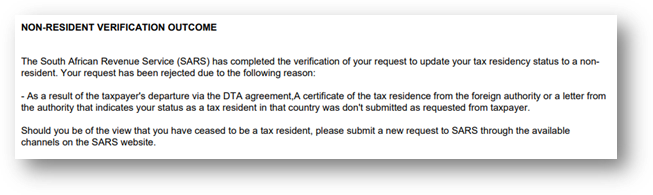

Old Generic Generated Response

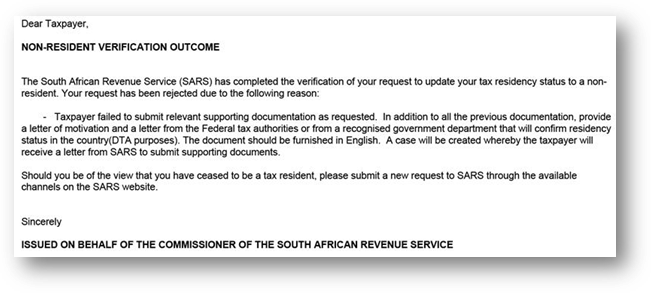

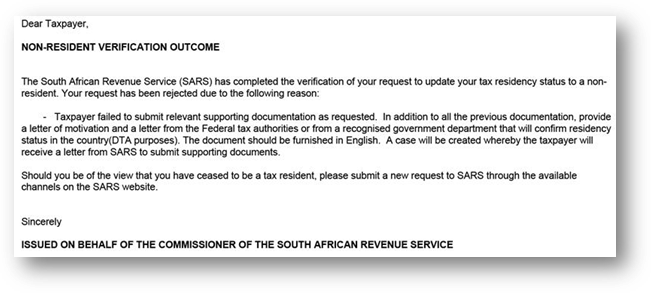

New Manual Intervention Response

The Cost of Delay: SARS Non-Residency Compliance Is Not Optional

One of the most notable shifts is the elimination of the “tick box” approach on tax returns. Previously, taxpayers could simply tick a box to indicate non-resident status, often without supporting documentation or formal approval. This shortcut is no longer accepted. SARS has introduced a non-resident section on the ITR12 return to ensure that non-residents complete only the relevant fields. This section is not automatically available but must be activated via the SARS Online Query System.

Now, SARS requires:

- A formal cessation process, initiated through eFiling;

- Issuance of a Notice of Non-Resident Tax Status confirmation letter before any tax return can reflect non-resident status; and

- Alignment between declared status and required supporting documentation.

Failure to follow this process will result in SARS continuing to treat the taxpayer as a resident, which has the practical implication of a compulsory tax obligation to declare worldwide income and exposing them to penalties, and in the most drastic cases, criminal prosecution.

The Risk of a Simple Error

Under this new process, even simple errors can have massive consequences. One of the most common, and costly errors, is mislabelling a document during submission. This may seem trivial, but it can trigger automatic rejection of the application, flag the submission for manual review, delaying processing, and create audit risk or raise questions about the taxpayer’s credibility.

When Time Is Not on Your Side

In practice, we have noticed that SARS’s system flags those who are rejected on their first submission, adding extra complexity and woes to an already taxing administrative process. This, in effect, could lead to delays amounting to weeks or even months to resolve.

In time-sensitive scenarios, the finalisation of your non-tax residency can be stalled and where even by a month will result in missed filing deadlines, the inability to access funds abroad, and exposure to double taxation. On top of this, the taxpayer may incur penalties levied monthly.

Too Late to Be Casual: The Tightening Grip of SARS Non-Residency Compliance

The SARS non-residency process is no longer a simple “tick box”; it’s a complex compliance obligation that demands attention to detail. A single misstep can lead to frustrating setbacks, and serious risks of non-compliance. For expats who have opted to have SARS confirm their non-resident status before filing outstanding tax returns, this is not the time to take shortcuts.

Ensure your application is accurate, timely, and fully supported. Engage a Cross-Border tax professional who understands the historic-current-and-future tax implications of the decision to break tax residency, foresees potential pitfalls, and can navigate the process with clarity and confidence. Getting it right the first time is not just ideal, it is essential. Your financial future may depend on it.