Although this move has been expected for a long time, SARS stated it is now acting decisively to increase the compliance levels of trusts.

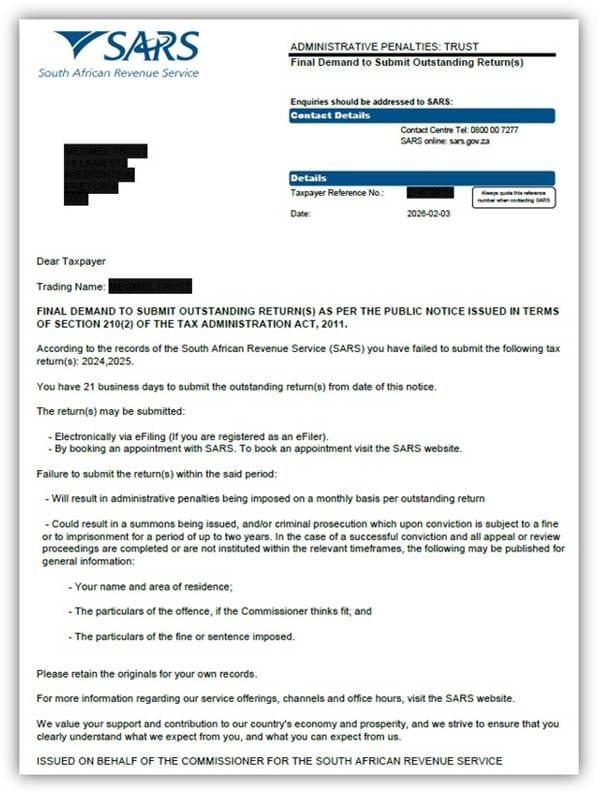

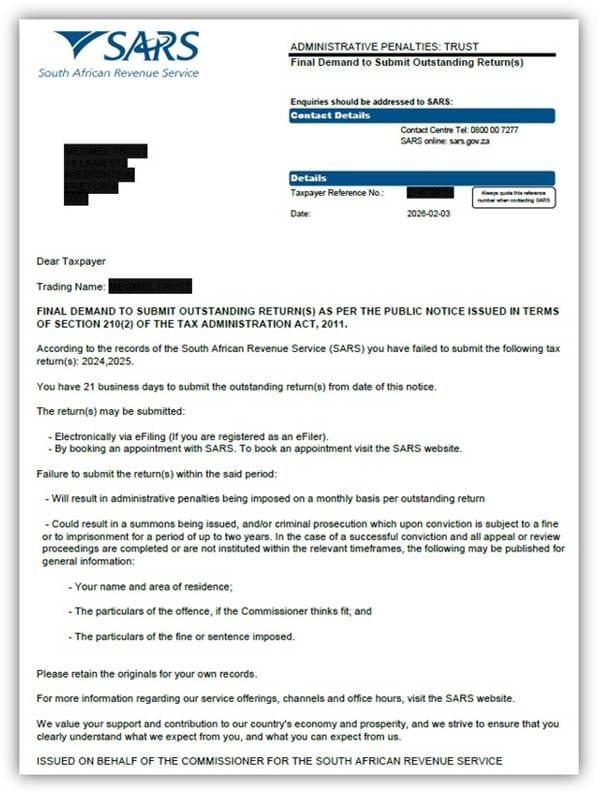

Final demands are issued in terms of section 210(2) of the Tax Administration Act. SARS said it will shortly issue the related public notice for the imposition of administrative non-compliance penalties for trusts.

“It is important that those in receipt of such final demands as referred to above, take steps to correct the non-filing of the annual income tax returns within the period before the administrative penalties will be raised.”

For years, SARS applied a measured approach to trust tax compliance. While filing obligations existed, outstanding trust returns did not typically result in immediate enforcement.

That position has now changed, and it comes with immediate consequences for trustees.

SARS reiterated that all trusts, whether economically active or passive, are required to submit annual income tax returns in accordance with the requirements set out in the public notice. It also emphasised that the responsibility for obtaining, maintaining, and updating accurate trust information rests exclusively with the trustees. This includes the initiation of de-registration processes for trusts that meet the applicable criteria.

From Warning to Action

On 3 December 2025, SARS issued a draft public notice confirming that trusts may be subjected to fixed-amount administrative penalties where income tax returns remain outstanding.

The notice applies to:

- income tax returns for years of assessment commencing on or after 1 March 2023 (i.e. 2024 year of assessment onwards); and

- trusts that have been issued with a final demand, where the outstanding return is not submitted within 21 business days.

The SARS message was clear: once final demands are issued, non-submission of the outstanding returns identified carries real financial consequences.

SARS Is Now Serving Final Demands to Trusts

What was set out in principle is now being implemented in practice.

Since 3 February 2026, SARS has begun issuing final demand notices to trusts with outstanding income tax returns for the 2024 and 2025 years of assessment. This was followed by SARS’ formal communication in this on Monday, 9 February 2026.

This timing is deliberate. Final demands followed:

- the close of the trust filing season on 19 January 2026; and

- the close of public comment on the draft notice on 28 January 2026.

Rather than allowing an extended post-filing grace period, SARS has moved swiftly to identify non-compliant trusts and initiate enforcement.

With the final public notice on penalties now imminent, the issuing of final demands is a critical step. Failure to comply within the 21-business-day window may result in fixed-amount administrative penalties being incurred.

Trustees Now Face Statutory Deadlines – Not Just Reminders

Once a final demand is issued, trustees are no longer dealing with routine compliance. They are responding to a formal enforcement action with a fixed statutory deadline.

From the date of the final demand, trustees have 21 business days to submit outstanding returns. There is no further grace period. Where returns are not submitted in time, administrative penalties will be imposed.

These penalties are levied under the Tax Administration Act, with monthly penalties ranging from R250 to R16 000, determined with reference to the taxable income of the trust.

The 21-Day Clock Starts When the Final Demand Lands

Trustees must act fast – delay is no longer an option. Final demands are here.

Trustees who are responding effectively are acting immediately by:

- confirming which trust returns remain outstanding;

- determining whether final demands have already been issued; and

- prioritising remediation within the statutory timeframe.

Compliance Now Comes Down to Execution

This is where many trustees will come under pressure.

For trustees managing multiple trusts or historic backlogs, this is rarely a question of intent. It is a question of execution capacity.

Where internal capacity is constrained, engaging a tax provider with specialist trust expertise, the ability to quickly identify outstanding returns and deal with compliance at scale and pace, may be the difference between timely compliance and automatic penalties.

SARS has drawn the line. For trusts, the era of leniency is over. SARS is no longer waiting for compliance – it is enforcing it.