The communication arrives quietly in the form of an official looking message, framed with urgency and authority, designed to provoke fear and immediate reaction. By the time a taxpayer realises that something is amiss, the damage has often already been done.

South African taxpayers are operating in an environment of heightened enforcement, increased automation and sophisticated data driven compliance measures by SARS. While these developments have strengthened revenue collection, they have also created fertile ground for fraudsters who exploit fear, urgency and unfamiliarity with tax processes. Understanding the difference is no longer optional. It is essential.

Fraudulent Communications and the Hallmarks of Deception

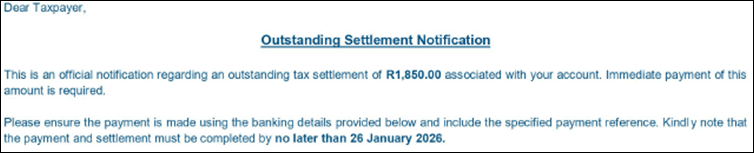

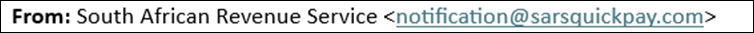

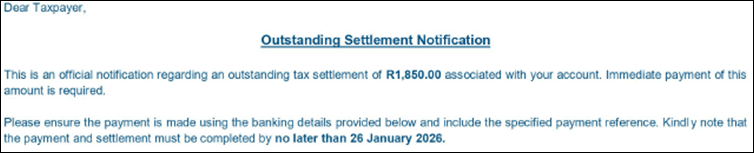

Fraudulent tax related scams are designed to provoke panic. They often allege outstanding tax liabilities, threatened audits, or imminent enforcement action. The objective is to bypass rational assessment and force immediate action from a recipient.

There are, however, clear indicators that taxpayers should recognise. Communications originating from non-official email domains, the absence of a taxpayer’s name and tax reference number, poor formatting or grammatical errors, and aggressive or threatening language are common warning signs.

Requests for immediate payment via electronic links or third-party platforms should be treated with particular suspicion. SARS does not demand instant settlement through unsolicited links or informal channels.

The consequences of engaging with fraudulent communications are severe. Bank accounts may be compromised, personal data harvested, and malicious software installed, exposing taxpayers to ongoing financial and identity related risks. Importantly, even historically compliant and financially sophisticated taxpayers are not immune.

The correct response is to pause, independently verify the communication through eFiling, and seek professional guidance before taking any action.

Verification Before Action Remains the Safest Approach

Before responding to any unexpected or alarming tax related communication, taxpayers should independently confirm its legitimacy and authenticity. This includes accessing the SARS eFiling platform directly, using verified contact details, or consulting a trusted tax practitioner.

Links, phone numbers, or instructions contained within the message itself should not be relied upon.

This simple step can prevent financial loss, identity theft, and months or years of administrative difficulty. Verification should always precede action.

When the Tax Debt Is Legitimate and What Taxpayers Should Know

It is equally important to recognise that not every communication is fraudulent. Where a legitimate tax liability exists, SARS does provide structured relief mechanisms to assist taxpayers in managing their obligations.

These include payment arrangements, where liabilities are settled over monthly instalments in accordance with taxpayer cashflow, and compromises of tax debt, where interest and penalties are written off depending on a taxpayer’s financial hardship. There are also suspension of payment requests which are used during the dispute or intended dispute process. These measures are designed to promote compliance while recognising financial reality.

However, navigating these processes incorrectly can significantly worsen a taxpayer’s position. Missed deadlines, incorrect assumptions, or reliance on informal advice can result in escalating penalties and interest and may ultimately trigger formal collection proceedings which commence with a Letter of Final Demand issued by SARS. Proper professional guidance ensures that rights are protected, obligations are met correctly, and unnecessary exposure is avoided.

Ignoring Legitimate SARS Correspondence Carries Serious Consequences

While fraudulent communications should be disregarded and reported, ignoring valid correspondence from SARS is extremely risky. Administrative penalties and interest can accrue rapidly.

SARS may appoint third parties to recover outstanding amounts, initiate garnishee orders, dip into bank accounts, or proceed with civil judgments where assets are ultimately attached and sold in recovery of debt amounts.

Ignoring a lawful notice does not make a tax debt disappear. It magnifies it. Early and informed engagement remains the most effective way to manage exposure and retain control over the outcome.

Vigilance, Not Fear, Is the Taxpayer’s Strongest Protection

Fraud thrives on panic. SARS operates through statutory process and procedure. Understanding this distinction is essential to staying protected. A rushed payment, an impulsive click, or a neglected notice can have consequences that extend far beyond the immediate moment.

Vigilance is not optional. It is essential. Taxpayers should pause before acting, verify every communication, and obtain professional guidance when uncertainty arises. These steps are not merely precaution but are fundamental safeguards.

Early verification, informed engagement, and professional guidance remain the most effective tools available to taxpayers. Acting decisively, but correctly, preserves rights, limits exposure, and prevents unnecessary escalation.

Taxpayers who are uncertain about the authenticity of a SARS communication, who are facing enforcement action, or who require assistance in managing existing tax liabilities are encouraged to seek professional support without delay. An experienced professional hand is required to engage with the SARS in a structured and defensible manner.

Prompt and informed action can be the difference between resolution and lasting financial harm.