This may be a costly oversight for wealthy South African expatriates in an era of stricter enforcement and fewer exemptions where SARS is tightening its grip on compliance and eyeing higher revenue collection – with high earners firmly in the spotlight.

The 2025 Budget Speech underscored the reality that individuals earning above R1 million per year remain the backbone of the country’s tax base.

In 2024/2025, individual taxpayers in this income bracket represented 6.7% of registered taxpayers but contributed 46% of South Africa’s total personal income tax. In 2025/2026, that figure stands at an estimated 7.3% of taxpayers paying 48.6% of all personal income tax, showing the financial weight of South Africa’s tax system clearly rests heavily on the shoulders of high-income earners.

At the same time, tax professionals warn that this is also the group of taxpayers who are highly mobile and can easily move abroad. Earlier this year SARS Commissioner Edward Kieswetter said the tax authority’s High Wealth Individual Unit (HWIU), which collects data on individuals owning more than R50 million in assets, found about 2 800 individuals that fit that category. Among them they hold R150 billion of assets offshore.

Fewer Expats Leaving the Tax Net: Why It Matters

SARS statistics reveal an interesting trend. In 2014, 4,102 taxpayers earning above R1 million formally declared a change in tax residency. By 2023, that number had dropped to 1,722 taxpayers. So, while a large number of South Africans are still believed to seek new opportunities abroad, fewer individuals are formally exiting the tax system.

This raises the important question whether all those who leave the country correctly update their tax residency status with SARS.

If not, they may be in for an unpleasant surprise, as failing to formally cease tax residency can result in unexpected tax liabilities in South Africa, especially as SARS continues to cast its net wider.

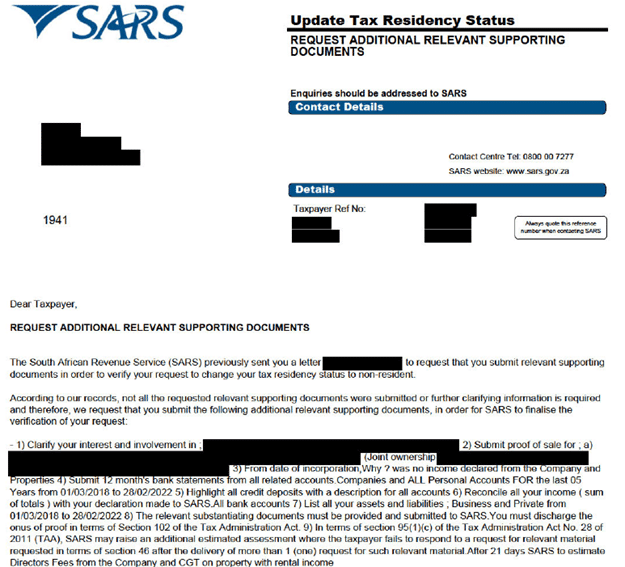

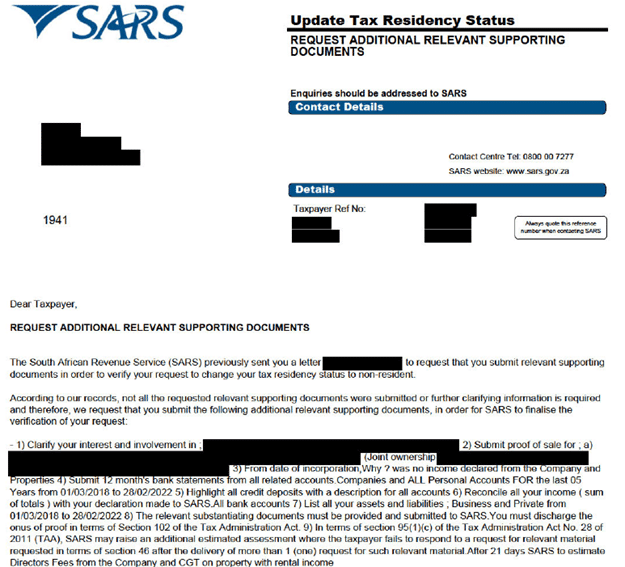

The tax authority is no longer taking a passive approach to tax compliance. In practice, we increasingly see SARS scrutinising taxpayers’ financial backgrounds, with detailed request for among others, company interests and involvement, company financials, rental income, Capital Gains Tax calculations and crypto related information.

These requests, as seen in the example below, often follow a submission of an application for a SARS Notice of Non-Resident Tax Status, the official confirmation that one has ceased to be a tax resident of South Africa.

In this new era of enforcement, it is essential for South African expatriates and high-income earners to understand their tax obligations back home. The assumption that it automatically ends at the border is no longer a safe one.

Stay Ahead of SARS: How Expats Can Safeguard Their Income Abroad

Under South African tax law, several options are available to South Africans who leave the country to work overseas — whether temporarily or permanently — to protect their worldwide income from taxes in South Africa. Understanding these options is vital, to ensure compliance and mitigate your tax liability in South Africa.

For South African tax residents who earn income overseas, the Section 10(1)(o)(ii) foreign employment income exemption can provide relief. This exemption is designed to prevent double taxation, but it comes with strict requirements, including that you must spend more than 183 days outside South Africa in a 12-month period, with at least 60 of those days being continuous. Only employees qualify, and compliance with SARS’ conditions is essential. Expressly excluded, are independent contractors, consultants, and self-employed individuals.

If your intention is to cut ties completely, you must formally cease your South African tax residency on a permanent basis. This involves showing that you are no longer considered to be ordinarily resident for tax purposes. Once residency is ceased, you are taxed in South Africa only on South African-sourced income, such as property rentals, rather than your worldwide earnings.

South Africa’s network of double taxation agreements (DTAs) with other countries may offer protection to those who do not fit neatly into either category mentioned above. A DTA offers a variety of mechanisms that taxpayers may rely on for relief, including temporarily ceasing of tax residency. This also requires a formal application to SARS.

Note that this mechanism does not require that you declare South Africa to no longer be your home.

Whether you rely on the foreign employment exemption, pursue formal cessation of permanent residency, or make use of a DTA to cease tax residency on a temporary basis, it is key to ensure your affairs are properly managed. Without the correct process, South Africans abroad risk remaining within the local tax net longer than expected.

Protecting your wealth abroad starts at home with making an informed decision on formalising your tax residence status. With SARS getting increasingly stricter on compliance, professional advice can help ensure you remain compliant while avoiding unnecessary tax burdens.