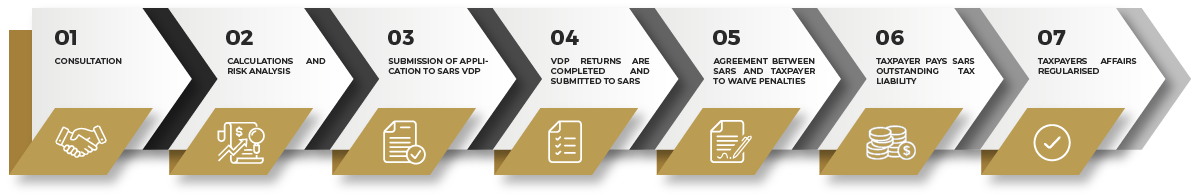

VOLUNTARY DISCLOSURE PROGRAMME

Non-disclosure to SARS may attract massive penalties!!

Should you be guilty of not completely disclosing your income or tax liability to SARS, you are on SARS’ radar and they may impose massive penalties, up to 200% of the value of the default in some cases.

SARS is currently implementing an extensive collection drive, and it is, therefore, prudent to submit a VDP application before SARS pulls the trigger and begins to pursue non-compliant taxpayers.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)