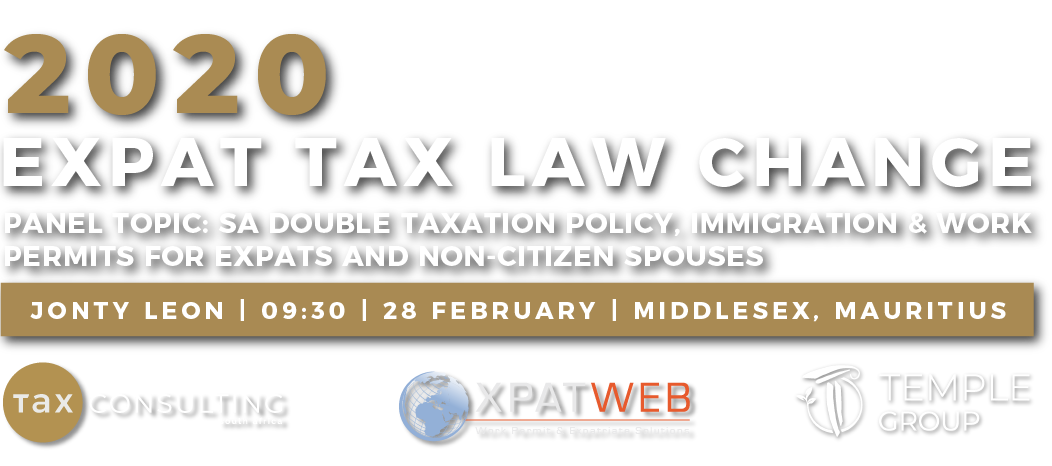

SOUTH AFRICAN EXPAT TAX LAW CHANGE EFFECTIVE IN MARCH 2020

Temple Group is pleased to invite you for a complimentary workshop on the subject matter, with panellists from Tax Consulting South Africa, the EDB, and an Immigration expert from our Expat Desk.

The objective of this workshop is to allow our clients a better insight into the process of relocating from one’s country of residence to Mauritius, its tax and other implications, and the various schemes and solutions available around such activities.

The panel will available for a Q&A session, as also for in-person network meetings.

Given the limited seating, we request you to confirm your presence via email.

We thank you for your continued patronage, and look forward to welcoming you accordingly.

KEY AREAS OF THE PRESENTATION

- Dealing with the fundamentals of international tax vs. South African tax and the principle that South Africans must always have a tax protection strategy;

- The history to the expatriate tax law change and the not widely reported primary motivations for the expat tax law change;

- The submission to Parliament in 2017 on behalf of South Africa expatriates, why the R1m exemption was allowed, the amended tax law and the remaining technical concerns not addressed by National Treasury and SARS;

- Financial Emigration – when is this viable and when not, criticism and opportunity;

- South Africa / Mauritius Double Tax Agreement – when is this viable and when not, risks and opportunity;

- Planning considerations where Financial Emigration and / or Double Tax Agreement relief not possible, including compliance strategy;

- Retirement in South Africa, tax risks associated with ‘end of service’ gratuity and other lump sums, tax considerations for continued South African investments especially into retirement vehicles, rental properties SARS audit approach etc.;

- Inheritances from or to family in South Africa, donations’ tax, forex and exchange control planning for inward and outward remittances;

- Common Reporting Standards, criminal offences standards, optimal tax planning and caveat against various tax ‘schemes’ being punted;

- LexisNexis guide on Expatriate Tax.

ABOUT THE AUTHOR

Jonty holds an LLB law degree and has 8 years of legal experience in various aspects of South African and international law.

He is an admitted attorney of the High Court of South Africa with both practical litigation and consulting experience.

He has worked in law firms focusing on dealing with litigation and contractual disputes.

Jonty moved from the pure practice of law to the consulting industry and has entrenched himself within tax law, specifically dealing with the elements of tax residency and solutions in and around this area.

Jonty joined us after developing a budding career in litigation and dispute resolution to focus on tax law and the intricacies thereof.

He is a director and the legal manager of Financial Emigration (Pty) Ltd, a subsidiary of Tax Consulting SA.

He also assists with in house legal responsibilities for Tax Consulting and their subsidiaries.

EVENT DETAILS

MIDDLESEX, MAURITIUS

DATE:

Friday, 28 February 2020

TIME:

9:30 am – Noon

VENUE:

Middlesex Mauritius University Auditorium, Flic-en-Flac

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)