Non-Compliance Will Be Costly

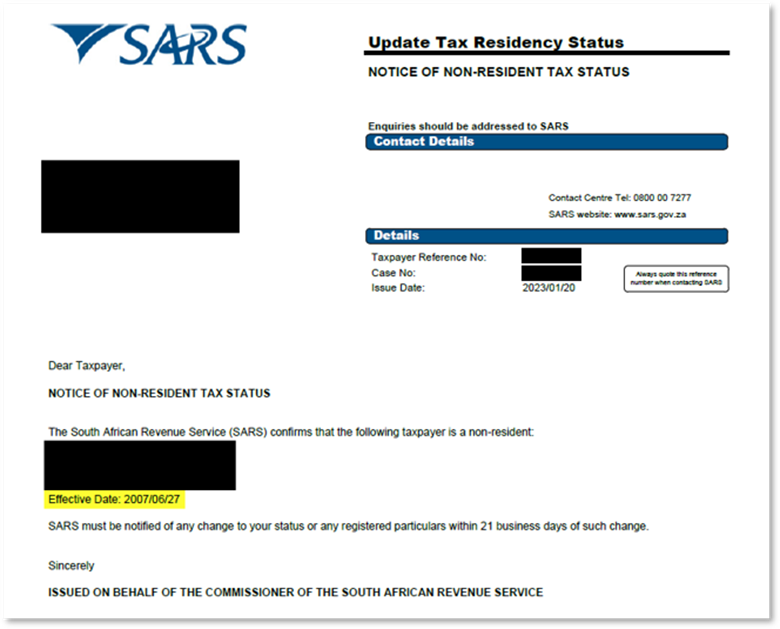

The requirement for a Notice of Non-Tax Residency Status Confirmation Letter is a recent development in South African tax law. SARS implemented this additional step in early 2022, and many taxpayers may have overlooked it at the time, seeing it as just an additional confirmation.

However, during the 2022 annual filing season, significant changes were made to the process of submitting non-resident tax returns. In particular, the non-resident tick box was greyed out, causing much confusion among taxpayers who were unsure how to proceed.

This change highlighted the importance of the Non-Tax Residency Status Confirmation Letter, as it is now a critical component in demonstrating your non-resident status to SARS and no longer serves as a mere formality. Without this letter, you may face significant challenges in completing your tax returns and demonstrating your compliance with South African tax laws. This letter will not only help you avoid any penalties or fines but also ensure that your tax affairs are in order and that you can proceed with confidence in your dealings with SARS.

Another scary trend has been the influx of expatriates approaching Financial Emigration regarding SARS enquiries, large tax liabilities incorrectly owed to SARS, and penalties and interests incorrectly allocated, due to the non- resident taxpayer’s status not being adequately confirmed with SARS.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)