NEWS | VERDICT ON RETIREMENT FUND WITHDRAWAL COMING SOON

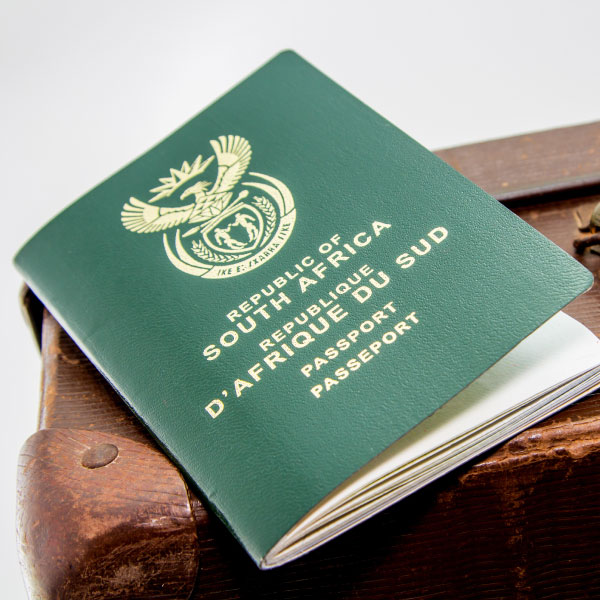

The time for South Africans who consider emigrating to learn their fate around their pensions is drawing closer.

NEWS | AN EVER-WIDENING TAX NET – NO REPRIEVE FOR EMIGRATING SOUTH AFRICANS

In 2017, the battle against government’s proposal to amend well established legislation, which provided South African residents living and working abroad an exemption from taxation on their foreign employment income reached a conclusion.

NEWS | WARNING OVER GOVERNMENT’S PLANS TO CHANGE SOUTH AFRICA’S EMIGRATION RULES

A number of tax and financial groups have issued warnings over a new draft bill which will introduce changes for South Africans looking to take their retirement funds out of the country.

NEWS | TAX DEBTS 101: FACTS VS FICTION – WHAT YOU NEED TO KNOW

Received a Final Demand from SARS? Where did this tax debt even come from? Is the notification really from SARS?

NEWS | A LANDMARK VICTORY FOR SARS OVER OBSTRUCTIVE TAXPAYERS

As South Africans, we have borne witness to certain high-profile individuals adopting what is referred to as the “Stalingrad Defence” in litigation, in an effort to postpone their day of reckoning at all costs.