TAX CONSULTING SA CONTRIBUTIONS

EXPAT TAX & IMMIGRATION

THE NEW EXPAT TAX VS SARS AUDIT STRATEGIES

THE UNCERTAIN FUTURE OF FINANCIAL EMIGRATION

WORK VISAS ACROSS AFRICA

EXPAT TAX OR OFFSHORE WORKERS AND SEAFARERS

CASE LAW

CASE LAW WRAP UP: COURT RULES APPLY TO BOTH SARS AND TAXPAYER

The issue in this matter was whether the step followed by the taxpayer in launching a default judgment application constituted an irregular step in terms of rule 30 of the Uniform Rules of Court (“the Rules”).

CASE LAW WRAP-UP: ALFDAV CONSTRUCTION CC VS THE SOUTH AFRICAN REVENUE SERVICE

CASE LAW WRAP-UP: REMISSION OF INTEREST

CASE LAW WRAP UP: CANYON RESOURCES

BINDING RULINGS

BINDING RULINGS 339

BINDING RULINGS 40

BINDING RULINGS 52

BINDING GENERAL RULING: BPR 59

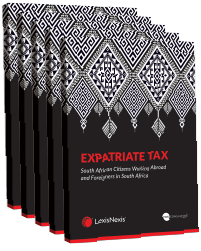

LEXISNEXIS EXPATRIATE TAX TEXTBOOK

“A MOST WELCOME ADDITION TO OUR BODY OF TAX LITERATURE AND WILL DOUBTLESS BE ESSENTIAL READING FOR ANYONE ADVISING HIS OR HER CLIENT WITH REGARD TO THE TAX CONSEQUENCES OF MIGRATION.”

JUDGE DENNIS M DAVIS

Ph.D. & Hon. Professor of Law

Chairman Davis Tax Committee

Judge President, Competition Appeal Court

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)